A Futures Contract has similar characteristics as a Forward Contract albeit with certain distinctions. The former refers to an assets current market price.

Forward Contracts Ppt Download

Chapter 2 Forward Contracts Questions Solutions Level 1 1.

. D The call option can be at-the-money. E The strike price on the put option must be at or below the forward price. In a forward contract the buyer and seller agree to buy or sell an underlying asset at a price they both agree on at an established future date.

At a specified price forward price At a specified time contract maturity or expiration date Typically not traded on exchanges. All of the above are characteristics of forward contracts. The party agreeing to buy the underlying asset in the future assumes a long.

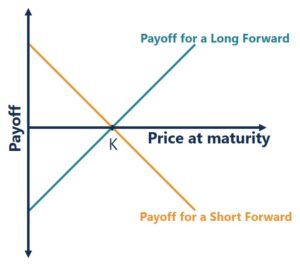

Trades on an organized exchange c. The time-1 profit for a long position in this forward contract is exactly opposite to the time-1 profit for the corresponding short forward position. Points 1 has a buyer and a seller trades on an organized exchange has a daily settlement gives the right but not the obligation to buy all of the above.

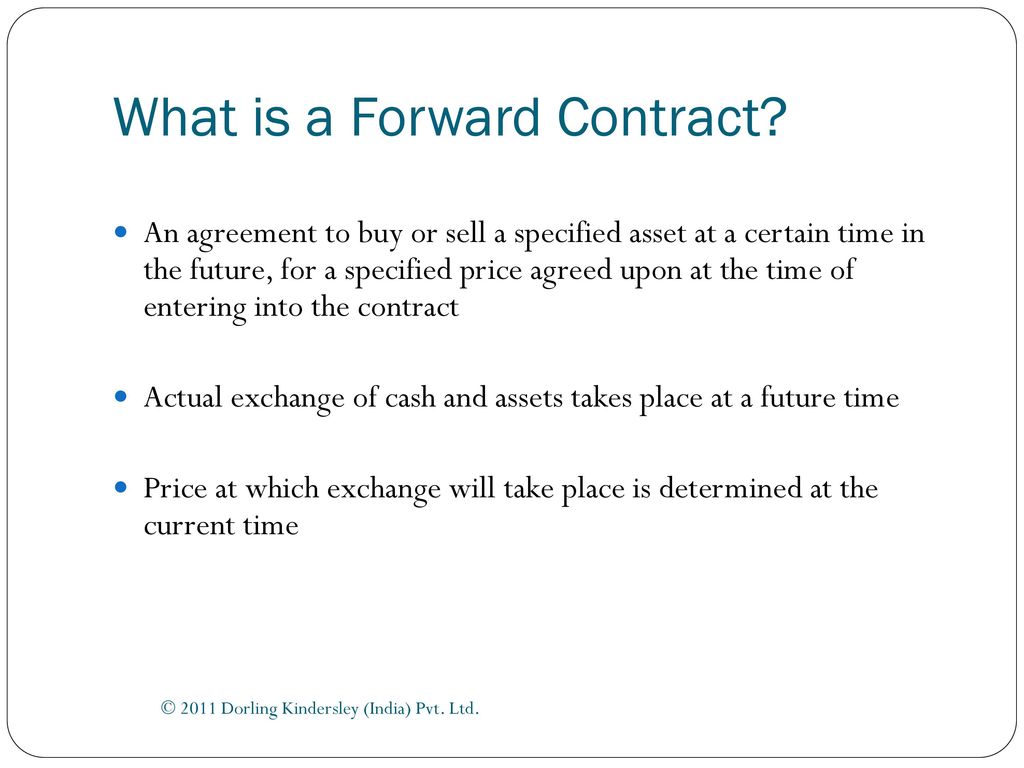

This price is calculated using the spot price and the risk-free rate. Has a daily settlement d. A forward contract is an agreement between two parties to buy or sell an asset which can be of any kind at a pre-agreed future point in time at a specified price.

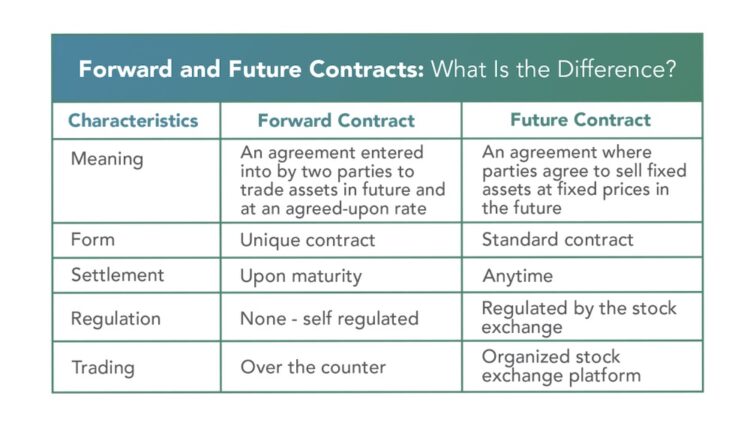

All of the above. Unlike futures which are regulated and monitored by the Commodities Futures Trading Commission CFTC forward contracts are unregulated. All of the above.

Many forwards can only be offset by agreement of the original parties. A forward contract is a customized contract between two parties to buy or sell an asset at a specified price on a future date. - The price of a 40-strike 1-year European call option is 6.

A forward contract often shortened to just forward is a contract agreement to buy or sell an asset Asset Class An asset class is a group of similar investment vehicles. Stock XYZ has the following characteristics. The PS index has the following characteristics.

The current price to buy one share of XYZ stock is 500. A forward contract is a current agreement to purchase an item in the future at a price to be paid in the future. Call strike prices at the forward price.

A forward contract is an agreement for buying or selling an underlying asset at a particular price on a specified date in the future. Traders who want to look beyond stocks and bonds for building a portfolio diversification can trade-in forward contracts. It simultaneously obligates the buyer to purchase an asset and the seller to sell the asset at a set price at a future point in time.

C The put option can be at-the-money. A forward contract has which of the following characteristics. All terms are negotiated by counterparties.

Derivative values are based on the value of another security index or rate. A forward contract can be used for hedging or speculation although its non-standardized nature makes it particularly apt for hedging. - The current price is 40.

Gives the right but not the obligation to buy e. A forward contract offers less liquidity than a futures contract as the future can be offset with any other party. Forward contracts exist as a private agreement between two parties with no standardization.

A forward contract is a private and customizable agreement that settles at the end of the agreement and is traded over the counter. However Futures were created to offset some of the disadvantages present within Forward Contracts. A forward contract has which of the following characteristics.

In finance a forward contract or simply a forward is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on at the time of conclusion of the contract making it a type of derivative instrument. Unlike Forwards which are traded on OTCs Futures are generally traded on well-regulated exchanges or markets. You are given the following.

They are typically traded in the same financial markets and subject to the same rules and regulations. C There is no comparative advantage to investing in the stock versus investing. Has a daily settlement d.

The buyer has a long position and the seller has a short position. E If there was a dividend of 3 paid 6 months from now then it would be more beneficial to invest in the stock rather than the forward contract. A forward contract has no immediate obligation but as time moves forward the price for.

B There are an infinite number of zero-cost collars. Gives the right but not the obligation to buy e. Trades on an organized exchange c.

The reason for entering. They dont get traded on exchanges and due to the customized nature of each contract third parties dont have an interest in buying them so they cant be resold. A forward contract has which of the following characteristics.

If the market maker will buy at 4 and sell at 450 the bid-ask spread is. Buyerssellers deal with an exchange not with each other. A futures contract has standardized terms and is.

A futures contract is a standardized contract traded on a futures exchange to buy or sell a certain underlying instrument at a certain date in the future at a specified price. Has a buyer and a seller b. At a specific price on a specified date in the future.

There are two ways for settlement that is delivery or cash basis. Sellers and buyers of forward contracts are involved in a forward transaction and are both obligated to fulfill their end of the contract at maturity. A forward contract is a private agreement between two parties.

No money changes hands at the moment the forward contract is entered. This price is called the forward price. Which of the following is most accurate regarding derivatives.

Exchange-traded derivatives are created and traded by dealers in a market with no central location. - The price of a 35-strike 1-year European call option is 9. Has a buyer and a seller b.

One share of the PS index currently sells for 1000. A forward contract is an obligation to buy or sell a certain asset.

What Is A Forward Contract Corporate Finance Institute

Forward Contract Definition Example Basics Risks

Forward Contract Example Meaning Investinganswers

Business Proposal Free Printable Documents Business Proposal Business Proposal Template Proposal

0 Comments